Closing entries - gain & loss on foreign exchange

Thanks for your help in advance.

It just time to close my books.

Wave accounting creates to accounts. Jane on Foreign Exchange and lost on Foreign Exchange. We do not have access to those accounts. I need to close those accounts for my year-end.

How can I create a journal entry to close those accounts to income summary?

Any help would be greatly appreciated.

0

Comments

Hi @Yan.

I remembered answering a similar question on here a while back. I did some digging and found this thread.

Does that answer your question?

It did help me understand a few things but did not help me that much. Let me give you more details.

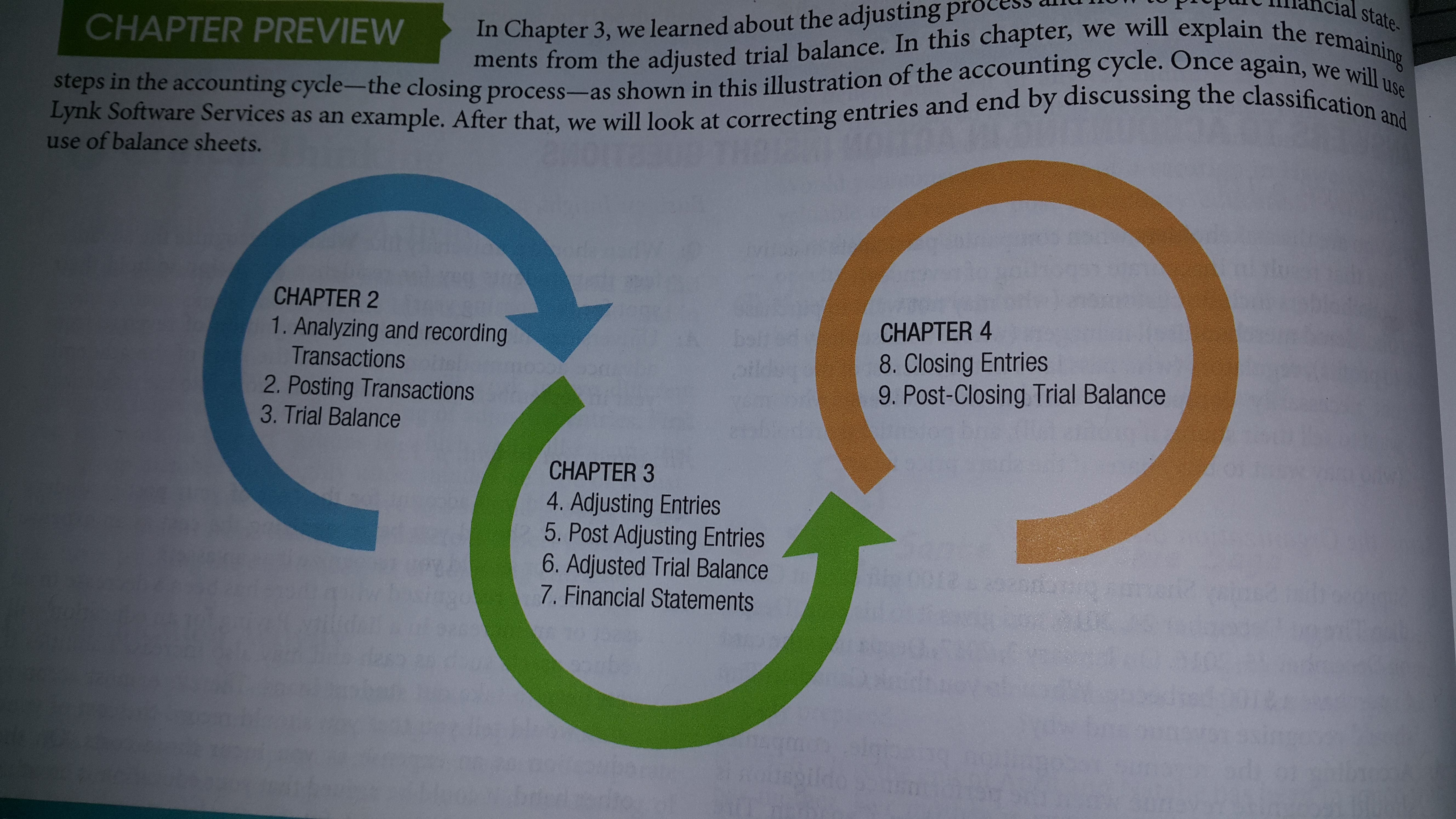

I just completed an accounting course from BCIT Vancouver.

I am trying to complete the last step. Closing Entries.

This website https://www.accountingcoach.com/blog/accounts-debited-closing-entries mentioned that gain and loss account should be closed...

"The closing entry or entries at the end of the accounting year will include 1) a debit to each revenue account that has a credit balance, 2) a debit to each gain account, and 3) a debit to each contra expense account. The amount of each debit entered into an account will be the amount of each account's credit balance.

The closing entry or entries will also include 4) a credit to each expense account that has a debit balance, 5) a credit to each loss account, and 6) a credit to each contra revenue account such as sales returns and allowances. The amount of each credit entered will be the amount of the debit balance in each account."

So I created an income account called "Income Summary". I Debited all Revenue accounts and Credited all expenses account to Income summary.

I learned that the balance of Income Summary should equal the year profit before I transfer its balance (Income Summary) to Ower's Capital (the equity in

Wave).

As there are these 2 accounts:

That I have no access to, Income summary does not equal my profit.

By playing with the app. I realized that Wave does close these accounts with the start of my new fiscal year.

All this to say that I am still a bit confused on how to complete the accounting process and closing my accounts to start my new fiscal year with all the temporary accounts (revenues, expenses and drawings) with a zero balance.

Any tips or pointers?

Thanks in advance. Your help is greatly appreciated.

Hi @Yan.

I understand what the issue is! Wave doesn't have a traditional approach to year-end accounting. In fact, we don't close out years at all.

Other accounting platforms don't allow you to touch historical data, but in Wave, you can pull up reports and make adjustments at any time. This means that your previous years never really "close". All that happens at year-end is that current year earnings get zeroed and added to previous year earnings.

At the start of your new fiscal year, you will see your new previous year earnings balance, fresh income and expense account balances, and your usual bank account balances.

What Wave doesn't do is put those amounts under a common account, such as retained earnings, that you can post transactions to.

I'm not sure what you mean by when you say that you don't have access to Gain/Loss on Foreign Exchange. Wave never closes any accounts or bars you from modifying them. If you need amounts from those accounts to be moved around, you can do this through journal entries on the Transactions page. That being said, considering that closing out your year by moving all of your earnings to a Retained Earnings account (and so on) isn't necessary, emptying out those two accounts should not be required either.

Hi Alexia,

Was browsing the community to get the answer but couldn't find it. Hence posting here

I've attached the screenshot for your understanding. In wave everything is done but the Unrealized Gain on Exchange is incorrect as its taking the transaction exchange rate as 1. (highlighted in the screenshot) how do it correct this.

Please advice.

Sincerely

Mohammed Sayeed

Hi, @Sayeed.

Unrealized gains and losses are always based on the current exchange rate. They represent the difference between the current exchange rate and the transaction's exchange rate. They represent gains or losses from waiting before exchanging currency.

So to break down your example...

([Amount of transaction] x [Current Exchange Rate]) - ([Amount of transaction] x [Transaction Exchange Rate]) = [Unrealized Gains/Losses]

(14,734.22 x 4.00411) - (14,734.22 x 1) = 44,263.17

Using "1" as the exchange rate for this transaction is telling Wave that for this specific transaction, one dollar was equal to one RM.

Does this clear things up?

Hi Alexia,

Many Thanks for replying back. I understand and have no issues with the break down here.

([Amount of transaction] x [Current Exchange Rate]) - ([Amount of transaction] x [Transaction Exchange Rate]) = [Unrealized Gains/Losses]

(14,734.22 x 4.00411) - (14,734.22 x 1) = 44,263.17

The exchange rate is incorrect.. it shouldn't be 1.

As in the screen shot the exchange rate is between 3 & 4.

Thus the question how do i edit and make correction to the specific transaction exchange rate (1). I was able to check and correct for all the other transactions except the ones in Gain Loss on Foreign Exchange Transcactions

Hi, @Sayeed.

My apologies for misunderstanding your question. That would've been something that would have been put in for that specific transaction. You'll have to find it on your Transactions page and remove change the exchange rate displayed there. Just expand that transaction and adjust the exchange rate here:

Hello Alexia, Many Thanks for your reply.

I've been looking for this specific transaction to edit for 2 weeks now. This is specific to the invoice generated and the amount is associated with that invoice and so the exchange rate.

I'm able to edit the invoice but not the exchange rate as shown here in the screenshot

Any suggestions?

Hi, @Sayeed.

Click on that invoice on your Invoices page and under "Get Paid" click on "Remove payment". Once the payment has been removed, record a payment to that invoice on the same date (September 20th, 2017) and to the same account.

That should solve the problem.

Hi Alexia,

I edited as suggested but still no difference, below screenshot.

I deleted this invoice and created a similar new backdated invoice as below and it solved the problem and all correct in General Ledger (below screenshot)

Many thanks for your time and support.

Kind Regards,

MOHAMMED SAYEED

Thanks for letting me know, @Sayeed. Happy to hear this worked out in the end!